Disclaimer: You must know how to read sticks at minimum requirement, that helps you to be able to foresee minutes ahead.

- www.tradingview.com register an account, it is free. once you registered, go to charts and add your favorite tickers and then above menu you will see the ‘fx’ icon, click on it and then click on the public library, there is Squeeze Momentum Indicator, apply it to your chart, that indicator will HELP YOU ALOT at least tell you the market is going down or up. Even before it turns bearish or bullish, not 100% accurate all the time but, I would say 90% time correct. that’s the no.1 public library at this moment. You can also apply some MA libraries, I use Madrid Moving Average, ranked at #12. With these 2 tools. I don’t make stupid decisions or be panicking easily.

- Candlesticks basics: When the candlestick draws below the same day’s lowest red candlestick, it will go down further. And if you see the green candlestick draws above the same day’s highest green candlestick, it is a good sign that it will go up more but if it fails to draw above the same day’s highest green stick, it will go downfall a lot again. There is an exception, if you are betting on the stock that has a lower market cap like below 10 billion, someone can buy huge blocks of stocks and make you panic sell, so beware when you deal with low cap stocks.

Same as 3 went above 2, and then it climbed.

then it slides, even more, when 4 hit the 3’s lowest price, it even crashed more.

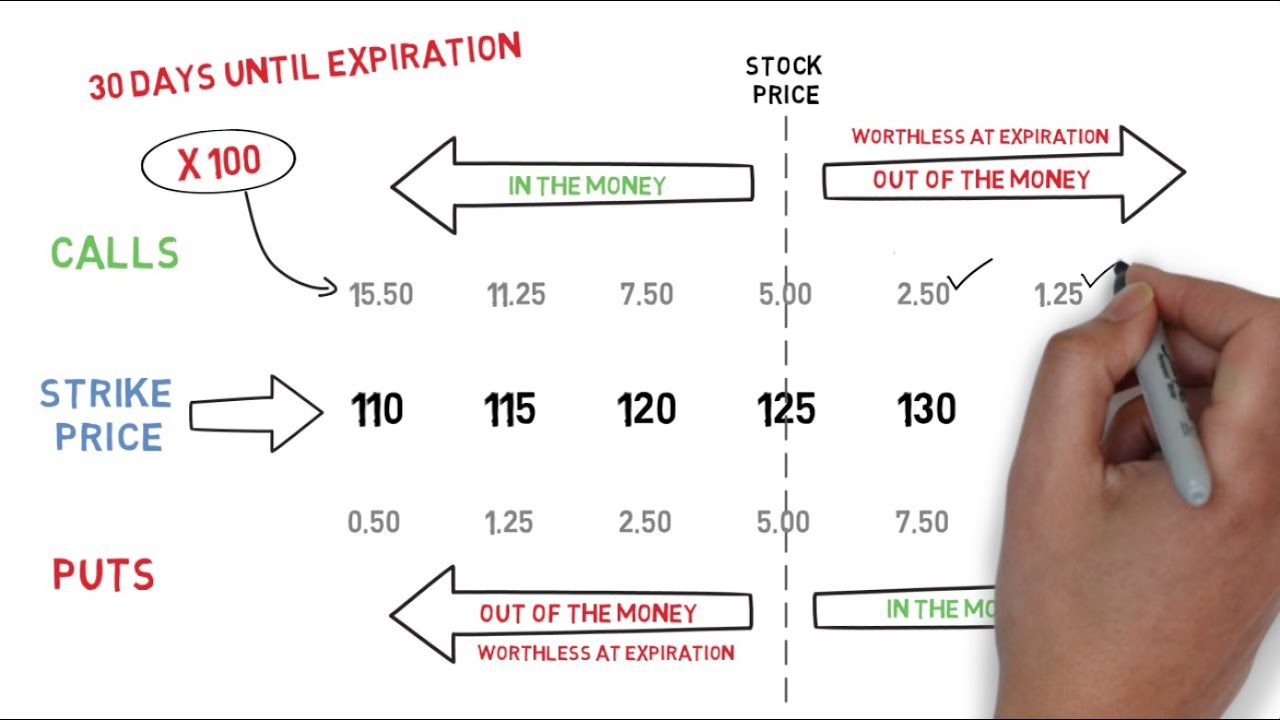

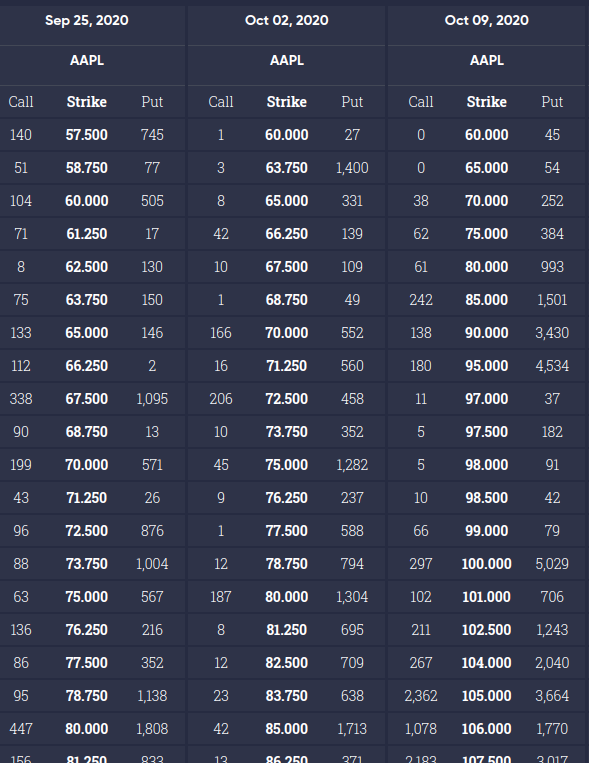

- How do I know if my ticker is bullish or bearish in options trading? This is a very important tool that you must have. and it is free.https://www.theocc.com will show you how many Calls or Puts orders got filled each expiration date. I basically follow the money, and 90% chances I win everyday. I follow the rich people. https://www.optionseducation.org/toolsoptionquotes/optionsquotes

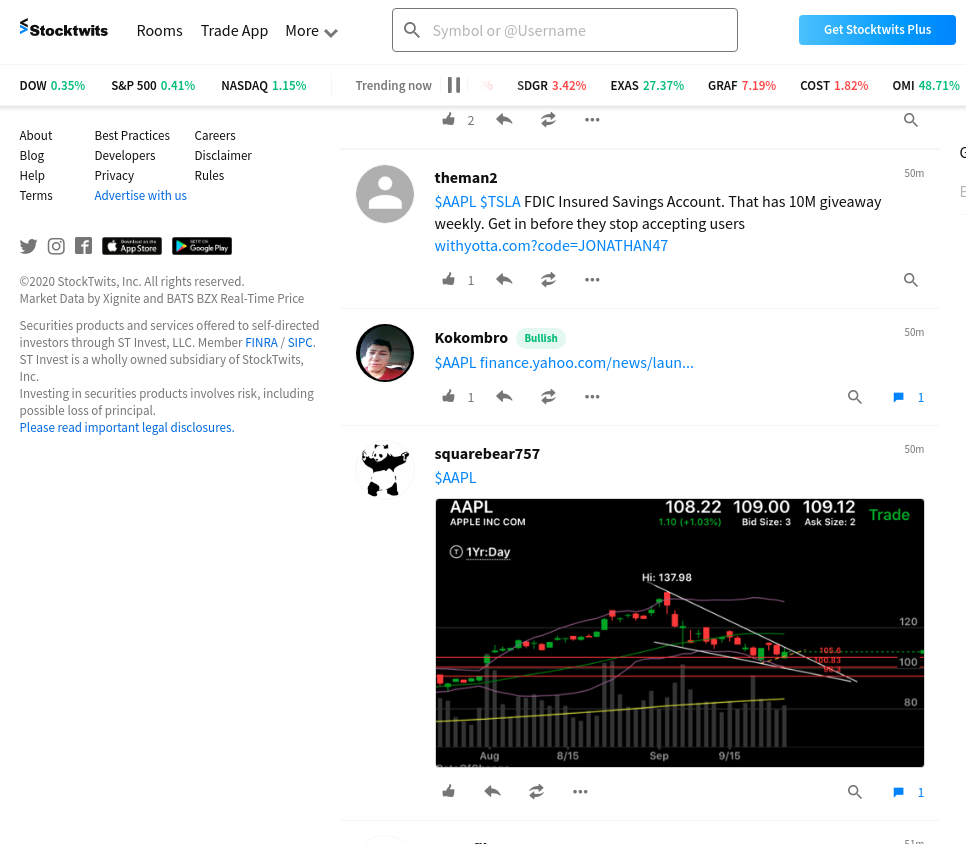

- I don’t do any research or read the news when options trading, only if I’m not sure on my betting then I read, but there is so much news to read and most of them fail in my opinion, doing research and reading news is for the longterm investment in my opinion, but are we? the good news is that https://stocktwits.com people will link the news in real-time on your favorite tickers. P.S. I don’t trust them saying. but I read the news they link.

- www.finviz.com I don’t really use this much, but some of you will find a very informative story on your ticker. if you haven’t visited them, try now.

Wrapping up, so the step you gotta do is, read the occ data and then on tradingview.com wait for the momentum start turning bullish or bearish, then open your position and then read the stocktwits.com for your ticker, and then when the momentum is about to turn, close your options. If you don’t have 25k cash, your best bet is using Webull platform, register new account or convert your account to a cash account, it will settle your close within

Since I use these tools above, I basically don’t lose easily regardless of the bullish or bearish market.P.S. #1 I usually don’t trade in the opening hours because it is so unpredictable, the market is pretty easy to predict around 2 hours before closing in my opinion. I prefer closing times.

P.S #2 Do not hold the bag, just sell it if it goes negative 20%, it will damage your mentality, (and it ages your face a lot faster!). You have more chance to win on the next round with different tickers. save money, don’t hold the bag. Also, I only use around 20% of my money, but win big with options. I would invest 50% on something I’m sure I will make a profit. otherwise, I keep it a low investment. If you hold the bag, and the rug gets pulled, you will even go crazier to recover the money but then lose all the money.

P.S. #3 I strongly recommend you to do paper trading in options for at least a couple of weeks. try Tradestation, deposit $1, this paper trading is really fun more than the games I ever played.

it would sound weird that a newbie sharing this information, but I really hope this helps you make money like I’m doing right now.